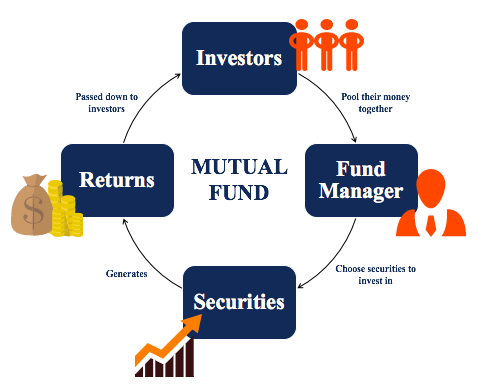

A mutual fund is an investment scheme that pools money from many investors which is further invested by a professional fund manager. The fund manager can invest this pooled money to purchase securities like stocks, bonds, gold, or any combination of these. Every mutual fund works around certain investment objectives and attempts to achieve the same.

Contact USWho likes paperwork anyway? Open an account just 2 minutes and get started.

From past performance and financial figures to holdings, analysing and choosing a fund has never been easier.

When it comes to money, safety comes first. Your investments will be safe and secure.

Mutual Fund investment not only provides a lot of benefits but can also help in reducing the risk by investing in diverse portfolios. If you are looking to invest in Mutual funds, such an investment can be made online as well as offline. The mutual fund application via offline mode can be done by filling up an investment application form. If you prefer to do it online, the prerequisites of how can you invest in MF online is given below.

Mutual funds offer professional investment management and potential diversification. They also offer three ways to earn money: Dividend Payments. A fund may earn income from dividends on stock or interest on bonds. The fund then pays the shareholders nearly all the income, less expenses. Capital Gains Distributions.

The price of the securities in a fund may increase. When a fund sells a security that has increased in price, the fund has a capital gain. At the end of the year, the fund distributes these capital gains, minus any capital losses, to investors. Increased NAV.

If the market value of a fund’s portfolio increases, after deducting expenses, then the value of the fund and its shares increases. The higher NAV reflects the higher value of your investment.

All funds carry some level of risk. With mutual funds, you may lose some or all of the money you invest because the securities held by a fund can go down in value. Dividends or interest payments may also change as market conditions change.

A fund’s past performance is not as important as you might think because past performance does not predict future returns. But past performance can tell you how volatile or stable a fund has been over a period of time. The more volatile the fund, the higher the investment risk.

nvestors buy mutual fund shares from the fund itself or through a broker for the fund, rather than from other investors. The price that investors pay for the mutual fund is the fund’s per share net asset value plus any fees charged at the time of purchase, such as sales loads.

Mutual fund shares are “redeemable,” meaning investors can sell the shares back to the fund at any time. The fund usually must send you the payment within seven days.